When a loved one passes away, the last thing any family wants to worry about is how to cover funeral costs and other end-of-life expenses. That’s where Final Expense Insurance comes in.

Also known as burial insurance or funeral insurance, final expense insurance is a type of whole life insurance policy specifically designed to cover the costs associated with a person’s death—typically including:

-

Funeral and burial or cremation costs

-

Outstanding medical bills

-

Small personal debts

-

Legal or probate fees

White dove as the Holy Spirit

💡 Why Is Final Expense Insurance Important?

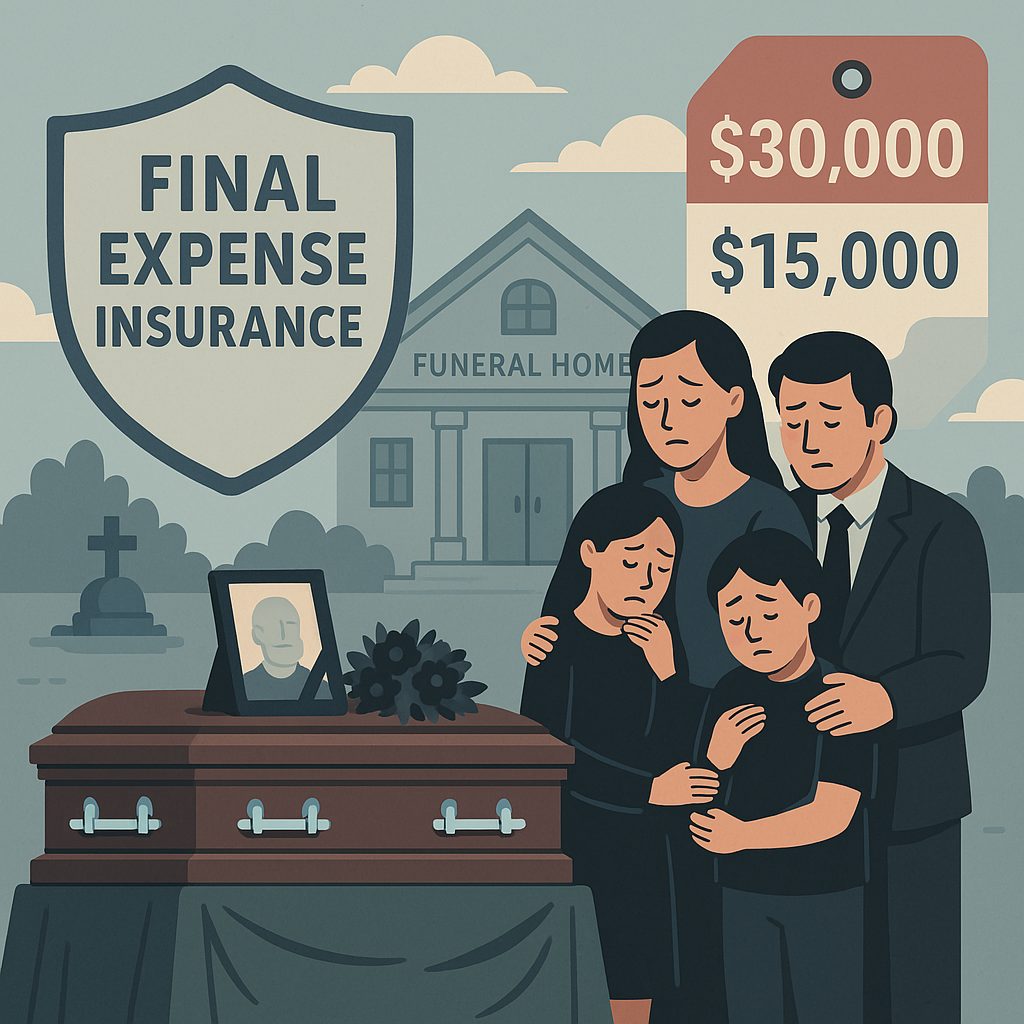

The average funeral in the U.S. can cost between $15,000 and $30,000, depending on the services involved. For many families, that can be a significant financial burden. Final expense insurance provides peace of mind—ensuring your loved ones aren’t left scrambling to pay bills in a time of grief.

Average tag

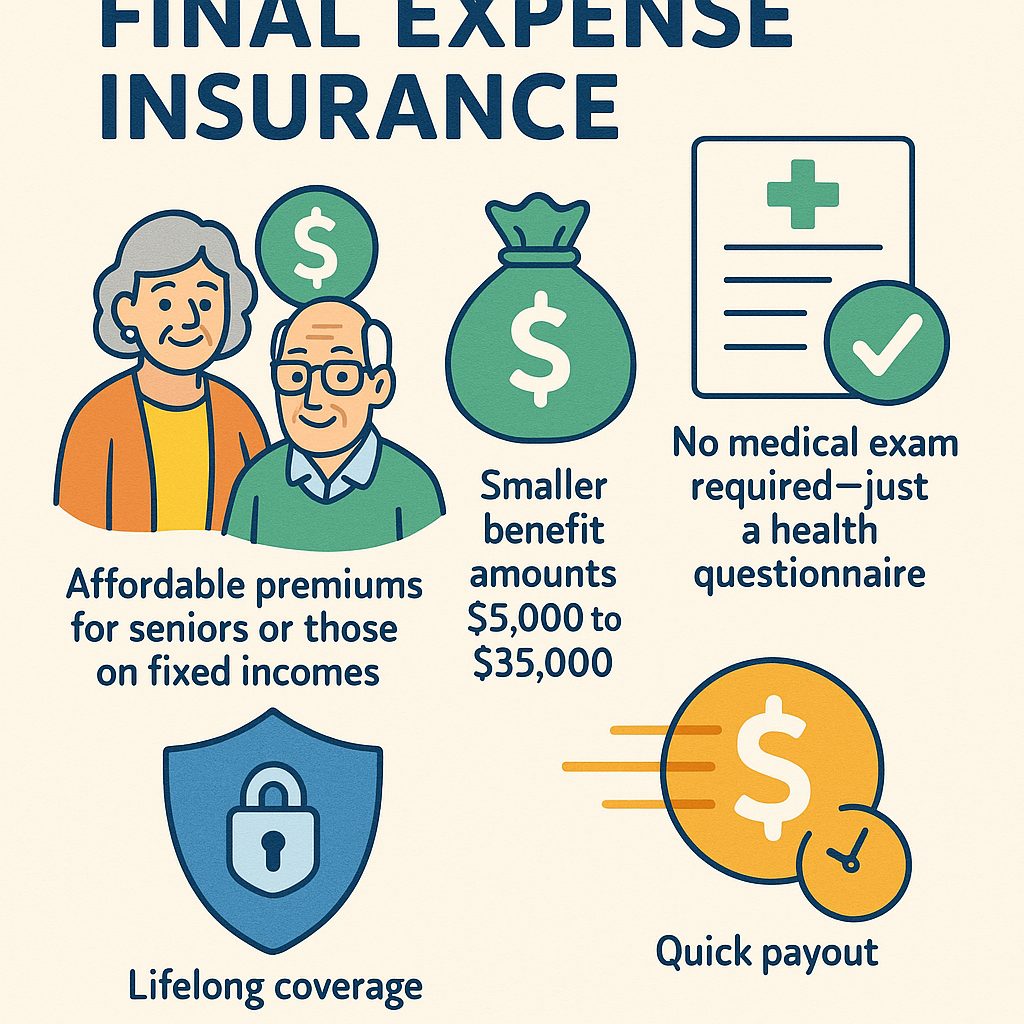

✅ Key Features of Final Expense Insurance

-

Affordable premiums – Designed for seniors or individuals on a fixed income

-

Smaller benefit amounts – Typically between $5,000 and $35,000

-

No medical exam required – Most policies only require answers to a few health questions

-

Lifelong coverage – As long as premiums are paid, coverage never expires

-

Quick payout – Helps beneficiaries cover expenses without delay

Final Expense Insurance offers peace of mind with affordable premiums, benefit amounts up to $35,000, no medical exam, lifelong coverage, and fast payouts—helping families manage end-of-life costs with ease.

👵 Who Should Consider Final Expense Insurance?

-

Seniors without existing life insurance

-

Those wanting to protect their family from financial stress

-

Individuals without savings set aside for funeral costs

-

Anyone seeking an affordable and simple way to plan ahead

🛡️ A Legacy of Love, Not Burden

Final Expense Insurance is more than just a policy—it’s a way to show your family you care, even after you’re gone. It’s a responsible and thoughtful part of any estate or legacy plan.

📞 Ready to Talk?

At Sandoval Financial and Insurance Center, we specialize in helping families protect what matters most. If you’re curious about your options or want a free quote, we’re here to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link